Here's What Over 2,000 Customers Are Saying!

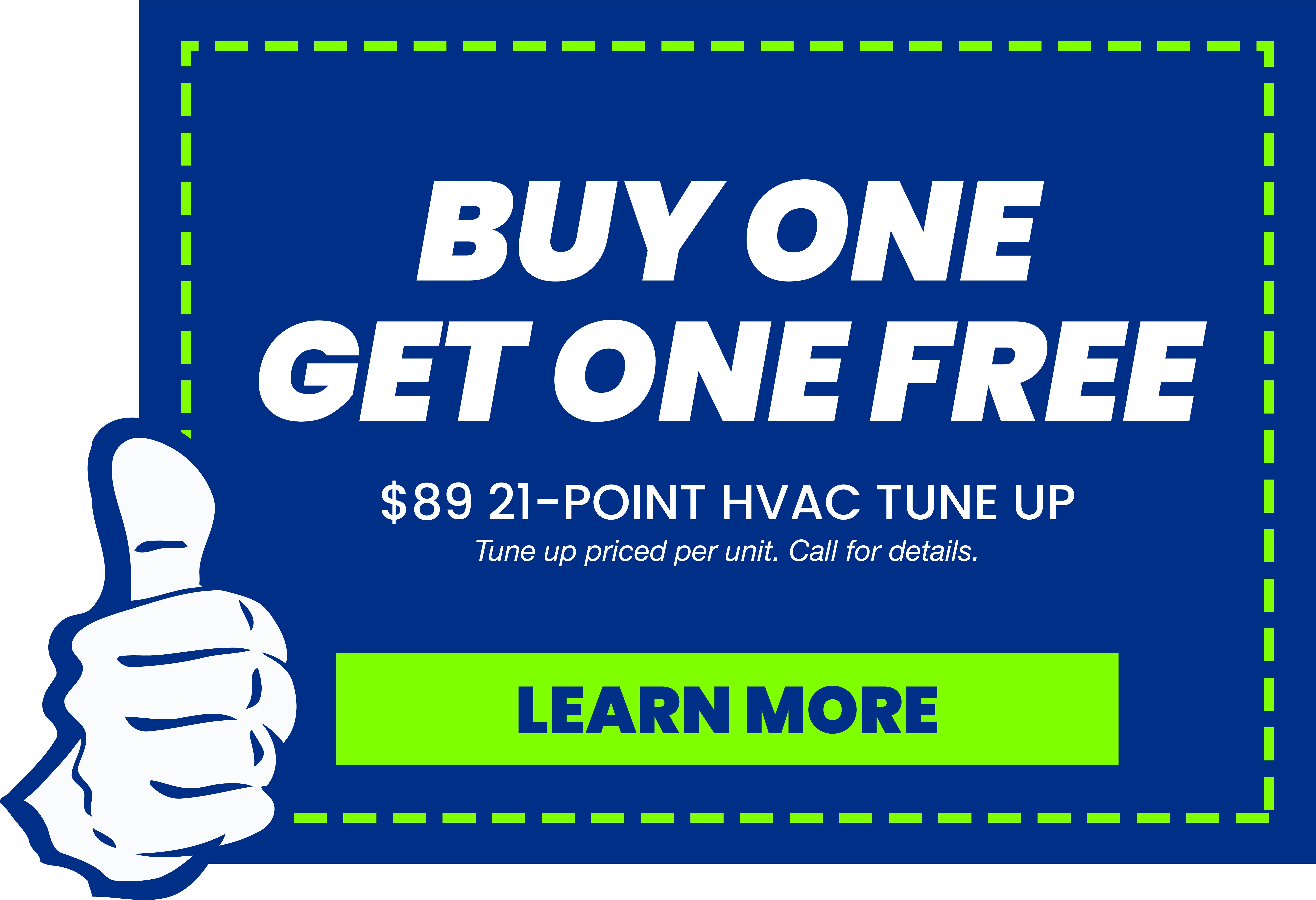

Coupons & Specials

The Preferred difference...

We believe that happy team members lead to happy customers and that every call and every customer matters. When you reach out to us for routine plumbing services, heating system installation, or even emergency air conditioner repairs, you’ll be treated to friendly, professional, and fast service from our experienced team. We’ve tackled thousands of jobs—over 60,000 to be exact—and we are fully prepared to help you with your home service needs!

Emergency Service Available

Up-Front Pricing & Financing

Fast and Local

Courteous Technicians

Highly Reviewed

Expertly Trained Technicians

The Preferred difference...

Emergency Service Available

Up-Front Pricing & Financing

Fast and Local

Courteous Technicians

Highly Reviewed

Expertly Trained Technicians

We believe that happy team members lead to happy customers and that every call and every customer matters.

When you reach out to us for routine plumbing services, heating system installation, or even emergency air conditioner repairs, you’ll be treated to friendly, professional, and fast service from our experienced team. We’ve tackled thousands of jobs—over 60,000 to be exact—and we are fully prepared to help you with your home service needs!